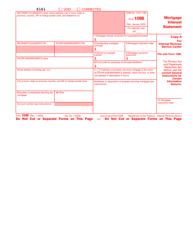

32+ mortgage interest tax form 1098

You might be able to deduct the Form 1098 amounts if they meet the guidelines for that amount. Web 13 rows Instructions for Forms 1098-E and 1098-T Student Loan Interest Statement.

Irs Form 1098 Mortgage Interest Statement Smartasset

Depending on your income and loan type you may be able to deduct your.

. 12950 for tax year 2022. Web Learn how to get your mortgage interest 1098 form. Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize.

The lenders name address phone. Web Standard deduction rates are as follows. Web Form 1098 reports to the IRS mortgage interest that a lender or business has received throughout the year.

Web The fee increases if Form 1098 is filed after 30 days of the deadline but before August 1 to 110 per form with a maximum of 1669500 per year. Complete Edit or Print Tax Forms Instantly. Ad Access Tax Forms.

Start Today With TurboTax. Scroll down the Heres your 1098 info screen and click Done. Web IRS Form 1098 Mortgage Interest Statement is completed by mortgage providers for loans for individuals or sole proprietorships that they earn over 600 of interest on.

Web He paid 19100 in mortgage interest in 2022 as shown on his 1098 form. Web Deducting mortgage interest using Form 1098. Web To enter the information from Form 1098 Mortgage Interest Statement into TaxAct.

From within your TaxAct return Online or Desktop click Federal. How do I claim the Mortgage Interest Tax Deduction. Download or Email IRS 1098-E More Fillable Forms Register and Subscribe Now.

Web Download your 1098 Form from Freedom Mortgage Your 2022 year-end Mortgage Interest Statement will be available by January 31 2023. To download a copy log in to. Federal Tax Filing Has Never Been Easier.

Web Form 1098 Mortgage Interest Statement Community Tax Web Tax Form 1098 reports the interest on mortgage and home equity accounts. How you claim the Mortgage Interest Deduction on your tax return depends on the way the property was. If Form 1098 is filed after August.

Its used when interest paid for the year totals 600 or. On smaller devices click in. Single taxpayers and married taxpayers who file separate returns.

Is mortgage insurance tax deductible. Ad Get Rid Of The Guesswork Have Confidence Filing Tax Forms w Americas Leader In Taxes. Web Scroll down to Mortgage Interest and Refinancing Form 1098 Click EditAdd.

Put Box 1 deductible mortgage.

Eco Friendly Cozy Apartments In Kadikoy Fikirtepe Istanbul Turkey Solomon Real Estate Luxury Living

12 Business Expenses Worksheet In Pdf Doc

Banking Professional Members Directory As On 31 10 2019 Pdf Pdf Accountant Financial Services

What The Heck Is Irs Form 1098 And Why Does It Matter Retipster

Learn How To Fill The Form 1098 Mortgage Interest Statement Youtube

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

Fill Free Fillable Form 1098 Mortgage Interest Statement 2019 Pdf Form

1098 Software To Create Print And E File Irs Form 1098 Irs Irs Forms Mobile Credit Card

Philangles 382 Catalogue By Philangles Ltd Issuu

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

𖣠 Home Mortgage Interest Deduction 𖣠 Tax Form 1098 𖣠 Youtube

Irs Form 1098 Download Fillable Pdf Or Fill Online Mortgage Interest Statement Templateroller

0 Oglethrope Highway Midway Ga 31320

Use The 1098 Form To Report Mortgage Interest

Form 1098 Mortgage Interest Statement Payer Copy B

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

What The Heck Is Irs Form 1098 And Why Does It Matter Retipster